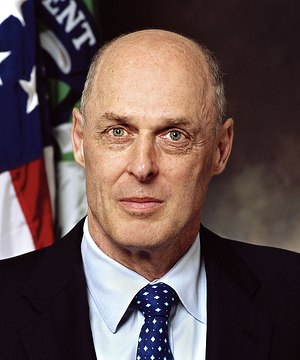

Image via Wikipedia

YOU know we’re in trouble when we’re told that the economic problems in Greece, Portugal and Spain, the most indebted countries in the euro zone, are likely to remain safely contained in those nations.

After all, we heard the same nonsense in 2007 from United States financial leaders talking about the subprime mortgage mess. Both Ben S. Bernanke, the chairman of the Federal Reserve Board, and Henry M. Paulson Jr., then the Treasury secretary, rolled out to reassure concerned investors that troubles in mortgage land wouldn’t permeate the rest of the economy.

As we all now know, mortgage woes were contained — to planet Earth. And so it may be with overleveraged nations in Europe.

Simply put, contagion is a fact of life in our interconnected global economy and financial markets. And that means investors must strap in for more gyrations in the stock and bond markets as the great and painful deleveraging that began in 2007 continues around the world.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=203db5d4-c7a8-490e-ba23-de595000070a)