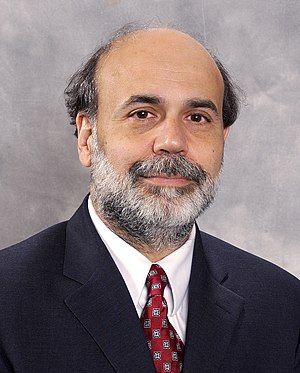

Image via CrunchBase

It's becoming clear that Google Wave, which is slowly emerging from closed beta, has potential to be much more than a text-messaging platform. As the telecommunications platform company Ribbit shows, and as does a frothy little videoconference app from 6 Rounds, Wave's architecture makes it a compelling platform for real-time streaming communication.

The Ribbit team recently showed me their prototype widget, which lets Wave users quickly set up a conference room inside a "wave" message on the service. Once you add the Ribbit conference widget to a wave, everyone in it becomes part of a potential voice chat. Users need to enter their phone numbers, which remain hidden from other users. Then anyone in the wave can call all the participants at once to start a conference. (Users can also call only particular people in the wave, if they wish.)

Google Wave meets conference calls, with Ribbit

Related articles by Zemanta

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=a6a40614-6963-4c8a-a622-00edfd0f2b6d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=99101593-f537-4241-8061-a027d4bceaeb)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=abb3d814-6aea-4c8c-83a2-5da5529f3fe1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=614ce9af-4c35-4b15-b1c6-4cae3fd8d8cf)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=a1f5b8b5-ebb9-42ed-abb1-06ae254be8b4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=0582e8f9-d963-497f-a89a-4fb8d82dbd9f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=1b0bd893-c567-4be2-b61c-84ed72ed3ff2)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=4955bee1-c945-43ad-ae01-cc4e6d89dbeb)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=235770d5-19ad-4562-9da3-5eed9bd58eb1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=ee2afedb-c35a-49fa-9169-a1846711d998)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=0a71f887-b00b-498f-9063-1a2188ffb59b)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=88358792-445a-4520-a4c6-2b9e4278ac21)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=45037219-ba88-499e-9058-d071b0b73793)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=a45575a7-25f7-4857-b5a4-260af8e1faed)