Wednesday, December 30, 2009

The current bull market in gold is far from over. In fact it is only beginning.

Tuesday, December 29, 2009

Fannie Mae and Freddie Mac: Just a Four-Letter Word?

Fannie Mae and Freddie Mac: Just a Four-Letter Word?

Monday, December 28, 2009

Backdoor Bank Bailout: Obama's Capitalist Cronyism

The proper interpretation of these events is succinctly laid out by Edward Harrison at the Credit Writedowns blog, to wit....Fannie Mae and Freddie Mac would be used as a nationalization of America’s mortgage problems via a back door bailout of banks. The evidence, therefore, tends to demonstrate that we have witnessed an orchestrated campaign by the Bush and Obama Administrations to recapitalize too big to fail institutions by hook or by crook, bypassing Congressional approval if necessary.

I'm open to a hearing of the argument that what the administration has done and is doing is justifiable, however Harrison further points out some really objectionable elements about this back door stealth bailout:

BRICs are Still on Top

BRICs are Still on Top

Gold: how high will the price go in 2010?

Image via Wikipedia

By Paul Farrow

"Notwithstanding the recent correction – and the possibility that gold may yet fall further before bargain hunters and other buyers (including central banks) reappear – the four pillars of gold-price strength remain intact.

They are inflation-fueling US monetary and fiscal policies; Central bank reserve diversification with the official sector being a taker rather than a supplier of gold in 2009 and the next few years; expanding retail and institutional investor participation in the United States, China, and around the world; and declining world gold-mine production.

We have consistently warned (and continue to do so) that gold’s advance would be marked by high volatility and occasional sharp reversals that would lead some to believe the long bull market in gold has ended – and we will continue to hold this view even if the metal falls back yet another $100 an ounce.

Looking ahead to 2010, don’t be surprised to see gold at $1,500 or higher by the end of next year."

Gold: how high will the price go in 2010?

Related articles by Zemanta

- Gold, dollar and euro: A love triangle into 2010 (investmentpostcards.com)

Government Housing Support Update

Here is a quote from Secretary Geithner from a recent Newsweek interview by Daniel Gross:

"We were very careful from the beginning ... to say that we are going to focus the bulk of the financial force on bringing interest rates and mortgage rates down to cushion the fall in housing prices and help stabilize home values, which will feed into people's basic sense of financial stability."To help keep this straight, here is a list of the status of a number of programs:

Sunday, December 27, 2009

Exclusive: Nexus One full specs detailed, invite-only retail sales starting January 5th?

Image via Wikipedia

We know you're itching to get your hands on a Nexus One -- Google's managed to build buzz here the way only a couple companies in the world know how. Unfortunately, it sounds like you're going to need to cross your fingers (or pull out that eBay emergency stash) to get one out of the gate, because we've got some intel here suggesting that it'll be available only by "invitation" at first. Our tipster doesn't have information on how those invites are going to be determined, other than the fact that it's Google doing the inviting -- if we had to guess, current registered developers are a strong possibility -- but the good news, we suppose, is that T-Mobile will apparently sell the phone directly at some to-be-determined point in the future. Oh, but that's not all -- we've got specs, too. Lots of them. Here are the highlights, but follow the break for the whole shebang:

Exclusive: Nexus One full specs detailed, invite-only retail sales starting January 5th?

Related articles by Zemanta

Saturday, December 26, 2009

Fannie And Freddie Receive Unlimited Future Funds To Stay Afloat

Image via Wikipedia

The government has handed its ATM card to beleaguered mortgage giants Fannie Mae and Freddie Mac.

The Treasury Department said Thursday it removed the $400 billion financial cap on the money it will provide to keep the companies afloat. Already, taxpayers have shelled out $111 billion to the pair, and a senior Treasury official said losses are not expected to exceed the government's estimate this summer of $170 billion over 10 years.

Treasury Department officials said it will now use a flexible formula to ensure the two agencies can stand behind the billions of dollars in mortgage-backed securities they sell to investors. Under the formula, financial support would increase according to how much each firm loses in a quarter. The cap in place at the end of 2012 would apply thereafter.

By making the change before year-end, Treasury sidestepped the need for an OK from a bailout-weary Congress.

While most analysts say the companies are unlikely to use the full $400 billion, Treasury officials said they decided to lift the caps to eliminate any uncertainty among investors about the government's commitments. But the timing of the announcement on a traditionally slow news day raised eyebrows.

Fannie And Freddie Receive Unlimited Future Funds To Stay Afloat

Related articles by Zemanta

- U.S. Treasury Ends Cap on Fannie, Freddie Lifeline for 3 Years (businessweek.com)

Thursday, December 24, 2009

Gravity will drag the $US

The US dollar ($US) is on a roller coaster. And since S&P downgraded Greece to BBB+, the dollar has been on the rise. One can attribute the recent shift in the $US to many things - improving US economic conditions, return to risk, or relative weakness in other G7 countries, whatever. But what is clear, is that the dollar's gaining some strength, 4.7% since the beginning of December on a trade-weighted basis.

But this is not sustainable. As economic recoveries diverge (i.e., the G7 recovery is expected to be slower than that in key emerging markets), the dollar will likely fall. That's just gravity, and a necessary condition for sorting out global trade flows.

Gravity will drag the $US

Wednesday, December 23, 2009

Default Nation

Image via Wikipedia

Daniel Gross

Strategic defaults—the phenomenon of people who could continue to make payments on the mortgages on their homes deciding to walk away from their obligations—are rising. According to the Wall Street Journal, strategic defaults are likely to exceed 1 million in 2009. This is making some worry about the very future of capitalism. Georgetown University business ethics professor George Brenkert told the Journal that borrowers who can afford to stay current are morally required to do so, and that were Americans to conclude they could just walk away from obligations, it would be disastrous. Mortgage Bankers Association CEO John Courson wondered about "the message they will send to their family and their kids and their friends?" Blogger Megan McArdle expressed disdain for people who chose to indulge themselves on consumer goods and services while not keeping current with their mortgages.

Um, do any of these people read the Wall Street Journal? Strategic defaults are the American way, and I'm not talking about strapped middle-class borrowers who prefer spending money on vacations to staying current on their payments. Deep-pocketed companies, billionaires, and institutions that can afford to stay current on payments strategically default all the time.

Morgan Stanley, for example, is a gigantic corporation. As of the second quarter, it boasted total capital of $213.2 billion. It certainly has the ability to make good on obligations incurred by its many operating units. But earlier this month Morgan Stanley said it would turn over five San Francisco office buildings to lenders rather than pay the debt on them. Why? Morgan Stanley foolishly paid top dollar for the buildings in 2007, when prices were really high. The values have plummeted, and tenants are hard to come by. "This isn't a default or foreclosure situation," spokeswoman Alyson Barnes told Bloomberg News. "We are going to give them the properties to get out of the loan obligation." Smells like a strategic default to me.

Related articles by Zemanta

- Mortgage delinquencies hit record high (msnbc.msn.com)

Tuesday, December 22, 2009

Google Mobile Phone – The Nexus One

The Apple iPhone is probably the handset that generates the most chatter on the web. Anything and everything regarding the iPhone is eagerly lapped up by fans of the device, and Apple do a good job of capitalising on this.

Recently, though, the most talked about phone is a handset that may not even exist, the fabled Google Phone. There is a lot of talk about the possibility of Google producing their own handset, hardware and firmware, and has been for years now. The rumours first started before the launch of Android, where Google were rumoured to be making their own phone, only for the Android operating system to be announced. The first phone running on the Android OS, the G1, released soon after.

The rumours have never really gone away though, and in the last few weeks they have returned with some force, with internet chatter reaching fever pitch. To be honest, it is hard to sort out the ‘could be true’ rumours from the ‘you’ve got to be kidding’ stuff. As the talk started to rise in level, it came to light that Google had in fact given some of their employees an ‘unknown’ handset, running on Android 2.1. This news soon spread across the web, with the Google employees openly talking about the phone on Twitter.

Google Mobile Phone – The Nexus One

Related articles by Zemanta

- Nexus One Very Fast And Thin (Specs) (mwd.com)

U.S. foreclosures top 1 million, report finds

Image via Wikipedia

By Jim Puzzanghera

Troubled home loans continued to mount in the nation's banks in the third quarter as even once-solid borrowers increasingly fell behind on their mortgage payments.

For the first time, foreclosures on mortgages serviced by U.S. national banks and savings and loans topped the 1 million mark, according to figures released Monday by the Office of Thrift Supervision and the Office of the Comptroller of the Currency. The percentage of prime borrowers whose loans were more than 60 days past due doubled from the July to September period a year ago, while more than half of all homeowners whose payment had been lowered through modification plans re-defaulted.

The report, which covers about 34 million loans or about 65 percent of all U.S. mortgages, underscores the obstacles facing policymakers trying to strengthen the nation's housing market. Persistent unemployment is making it tough for millions of homeowners to pay their home loans.

In addition, many people whose monthly installments have been lowered through mortgage modification programs still are unable to keep up.

Current and performing mortgages serviced by national banks and thrifts fell to 87.2 percent — the sixth-straight quarter that the quality of their home loan portfolios has slipped.

"Mortgage performance continued to decline as a result of continuing adverse economic conditions, including rising unemployment and loss in home values," the report said.

U.S. foreclosures top 1 million, report finds

Related articles by Zemanta

- Serious U.S. mortgage delinquencies rise (msnbc.msn.com)

Change Nobody Believes In

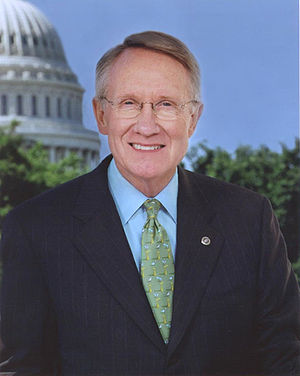

Image via Wikipedia

And tidings of comfort and joy from Harry Reid too. The Senate Majority Leader has decided that the last few days before Christmas are the opportune moment for a narrow majority of Democrats to stuff ObamaCare through the Senate to meet an arbitrary White House deadline. Barring some extraordinary reversal, it now seems as if they have the 60 votes they need to jump off this cliff, with one-seventh of the economy in tow.

Mr. Obama promised a new era of transparent good government, yet on Saturday morning Mr. Reid threw out the 2,100-page bill that the world's greatest deliberative body spent just 17 days debating and replaced it with a new "manager's amendment" that was stapled together in covert partisan negotiations. Democrats are barely even bothering to pretend to care what's in it, not that any Senator had the chance to digest it in the 38 hours before the first cloture vote at 1 a.m. this morning. After procedural motions that allow for no amendments, the final vote could come at 9 p.m. on December 24.

Even in World War I there was a Christmas truce.

The rushed, secretive way that a bill this destructive and unpopular is being forced on the country shows that "reform" has devolved into the raw exercise of political power for the single purpose of permanently expanding the American entitlement state. An increasing roll of leaders in health care and business are looking on aghast at a bill that is so large and convoluted that no one can truly understand it, as Finance Chairman Max Baucus admitted on the floor last week. The only goal is to ram it into law while the political window is still open, and clean up the mess later.

Related articles by Zemanta

- GOP Takes On Health-Bill Deal-Making (online.wsj.com)

Small-business bankruptcies rise 81% in California

The Obama administration's new plan to give a boost to small businesses reflects continued trouble in that sector, which is facing new failures even as much of the nation's economy is stabilizing.

As credit lines have shrunk and consumers have cut back on spending, thousands of small businesses have closed their doors over the last year. The plight of struggling firms has been aggravated by the reluctance of banks to lend money, said Brian Headd, an economist at the Small Business Administration's office of advocacy.

"While bankruptcies are up, overall, small-business closures are up even more," Headd said.

California has been particularly hard hit. The latest data show small-business bankruptcies up 81% in the state for the 12 months ended Sept. 30, compared with the previous year. Filings nationwide were up 44%, according to the credit analysis firm Equifax Inc.

The actual number of small businesses in trouble is probably higher, experts said, because many owners file for personal bankruptcy rather than seek protection for the business.

Small-business bankruptcies rise 81% in California

States' jobless funds are being drained in recession

By Peter Whoriskey

The recession's jobless toll is draining unemployment-compensation funds so fast that according to federal projections, 40 state programs will go broke within two years and need $90 billion in loans to keep issuing the benefit checks.

The shortfalls are putting pressure on governments to either raise taxes or shrink the aid payments.

Currently, 25 states have run out of unemployment money and have borrowed $24 billion from the federal government to cover the gaps. By 2011, according to Department of Labor estimates, 40 state funds will have been emptied by the jobless tsunami.

States' jobless funds are being drained in recession

Trillions Of Troubles Ahead

Trillions Of Troubles Ahead

There Is No Way Out Of This Box....

by Karl Denninger

There Is No Way Out Of This Box....

Sunday, December 20, 2009

Brokedown Palace: The Undermining of Property Rights in America

Zero Hedge recently highlighted the TPG raid on CDOs. This action puts into focus the alarming trend of the undermining of creditor rights. When even the Courts are in on the gang bang, what hope do we have?

The battlefield: CDOs, mortgages, corporate debt

The players: hedge funds, management teams, elected officials, lobbyists, unions

The weapons: loopholes, new precedents, bankruptcy court, political pressure

The Chrysler debacle was stink enough, but the trend of collateral tampering is an outright stench today. Property rights have allowed the U.S. to flourish. They are bedrock of our economy. They allow facilitate the spread of credit and economic growth that some other countries cannot match.

In Chrysler we saw legal precedent created where a *secured creditor* received less on its contracted collateral than unsecured creditors. In one fell swoop, we saw fiduciaries abscond, “disinterested” advisors incented to rubber-stamp, and the Courts join in on the rubber stamping party (more on this later). Most importantly, we witnessed a government that not only sanctioned this egregious behavior but astonishingly pushed for it. The Government actually labeled those who filed objections to the deal as “terrorists” (you can’t make this up). The Government actually vetoed Chrysler's offer to give secured creditors additional consideration. Our lawmakers were so involved that Chrysler's own attorneys tried to block discovery of their communications with Washington (the attorney’s clients were Chrysler, not Washington). We must never forget Obama’s alleged threat of using the “White House Press Core” to weaken what little opposition remained (who exactly were the terrorists?).

Brokedown Palace: The Undermining of Property Rights in America

Harder to buy US Treasuries

IT is getting harder for governments to buy United States Treasuries because the US's shrinking current-account gap is reducing supply of dollars overseas, a Chinese central bank official said yesterday.

The comments by Zhu Min, deputy governor of the People's Bank of China, referred to the overall situation globally, not specifically to China, the biggest foreign holder of US government bonds.

Chinese officials generally are very careful about commenting on the dollar and Treasuries, given that so much of its US$2.3 trillion reserves are tied to their value, and markets always watch any such comments closely for signs of any shift in how it manages its assets.

China's State Administration of Foreign Exchange reaffirmed this month that the dollar stands secure as the anchor of the currency reserves it manages, even as the country seeks to diversify its investments.

In a discussion on the global role of the dollar, Zhu told an academic audience that it was inevitable that the dollar would continue to fall in value because Washington continued to issue more Treasuries to finance its deficit spending.

Harder to buy US Treasuries

Saturday, December 19, 2009

$4.8 trillion - Interest on U.S. debt

$4.8 trillion - Interest on U.S. debt

4 Big Mortgage Backers Swim in Ocean of Debt

By MARY WILLIAMS WALSH

Even as the biggest banks repay their government debt in what is being heralded as a successful rescue program, four troubled giants of the financial world remain on government life support.

These companies, the American International Group, Fannie Mae,Freddie Mac and GMAC, are not only unable to repay the government, they are in need of continuing infusions that make them look increasingly like long-term wards of the state.

And the total risk they pose to the taxpayer far exceeds that of the big banks. Fannie and Freddie, in the final days of the year, are even said to be negotiating with the Treasuryabout greatly expanding the money available to them.

Though the four are not in all the same businesses, they were caught in one of the same traps: They sold mortgage guarantees — in some cases to each other. Now when homeowners default, as they are doing in record numbers, these companies are covering the losses. Essentially, taxpayer money to these companies is being used partly to protect banks and other investors who own the mortgages.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6a160005-6daf-4e09-a894-ded544a3412c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7654fac8-e2a1-4081-86c7-dbf6171c0b29)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=a856067c-4343-4ca9-a3b1-a35ed61520c4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b1e6cff8-cd61-4999-861b-e27c4c8a5ed8)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=4cac52f3-d39b-41da-acea-1664ef8c3ef5)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=0a3e1b6f-b69c-4d46-bd1e-7948688999c7)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ac9d43d0-e886-4b1b-9873-842f3fe62adc)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=29b2b40f-8a53-4411-bdc5-07545de567ee)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=6395326a-aaa8-4adf-a5c0-2427a505ec68)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=239d9d15-3bca-429b-b52e-d07c1fc982d1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e84cb1dd-e15a-4122-8b31-3605881c36a1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=977d0a2f-7cd6-427d-b66b-5114fe0455dd)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f6dcfe30-53e8-407e-aab1-b7cb48ae8ea0)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=23b259ea-d5d7-4dd9-92a5-0fa14df2a774)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d25565b4-250d-4dff-b5b7-3e4bd06d5a2d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=a7ed2243-4a57-4d0a-a6c9-5eda219f387f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=43de5394-6fbe-47af-aff8-deae649d6cf6)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=0eac84cb-f5b2-412c-bbb8-ba6bda92b43c)