By Candice Zachariahs and Ron Harui

China, whose $2.45 trillion in foreign-exchange reserves are the world’s largest, is turning bullish on Europe and Japan at the expense of the U.S.

The nation has been buying “quite a lot” of European bonds, said Yu Yongding, a former adviser to the People’s Bank of China who was part of a foreign-policy advisory committee that visited France, Spain and Germany from June 20 to July 2. Japan’s Ministry of Finance said Aug. 9 that China bought 1.73 trillion yen ($20.1 billion) more Japanese debt than it sold in the first half of 2010, the fastest pace of purchases in at least five years.

“Diversification should be a basic principle,” Yu said in an interview, adding a “top-level Chinese central banker” told him to convey to European policy makers China’s confidence in the region’s economy and currency. “We didn’t sell any European bonds or assets, instead we bought quite a lot.”

China’s position may make it harder for the greenback to rebound after falling as much as 10 percent from this year’s peak in June as measured by the trade-weighted Dollar Index. The nation cut its holdings of U.S. government debt by $100 billion, or 11 percent, through June from last year’s record of $939.9 billion in July 2009, according to Treasury Department data released today.

data released today.

U.S. Concerns

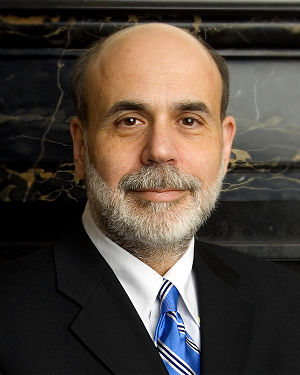

Concern the U.S. economy is faltering was underscored by the Federal Reserve on Aug. 10. Chairman Ben S. Bernanke said the central bank will reinvest principal payments on its mortgage holdings into Treasury notes to prevent money from being drained out of the financial system, its first expansion of measures to spur growth in more than a year.

“The pace of economic recovery is likely to be more modest in the near term than had been anticipated,” the Federal Open Market Committee said in a statement after meeting in Washington. “The Committee will keep constant the Federal Reserve’s holdings of securities at their current level.”

China’s holdings of long-term Treasuries fell for the first time in 15 months in June to $839.7 billion, a 2.5 percent drop. The nation’s overall Treasury position declined for a second month to $843.7 billion, the lowest since May 2009, Treasury data showed.

The decline represents the first year-over-year drop in China’s Treasury holdings since 2001.

China Favors Euro Over Dollar as Bernanke Alters Path

data released today.

data released today.