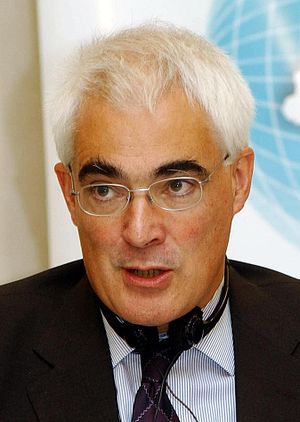

Image via Wikipedia

The Economist

THE most pressing piece of business for any new government will be coming up with a credible plan for restoring fiscal sanity. For the past year investors and credit-rating agencies have been living in a state of suspended disbelief as Britain’s public finances have deteriorated vertiginously.

In 2007-08, the year before recession hit, the budget deficit was £34 billion, equal to 2.4% of GDP. By 2009-10 it had risen to £167 billion, or 11.8% of GDP—the highest since the second world war—and it is likely to stay close to that this year (see chart).

Britain’s position looks dire compared with other big economies. According to the IMF, its deficit as a share of GDP will be the biggest among the G7 countries in 2010. Some of the borrowing will go away as the economy recovers. But on the Treasury’s latest projections the Institute for Fiscal Studies (IFS), a think-tank, reckons that spending cuts and tax rises worth around 5% of GDP are needed to put things right.

The parties differ on when and how to start. Both Labour and the Liberal Democrats want to wait until 2011, arguing that an early start could derail the recovery. Although Alistair Darling, the chancellor of the exchequer, has introduced a new 50% top rate of income tax on high earners this April, the real retrenchment is to begin next year and carry on until 2016-17. Among his revenue-raising measures is increasing national-insurance contributions from April 2011. But on spending his account lacks crucial detail (the Lib Dems have been more specific). And his timetable is anything but urgent, leaving the deficit at 4% of GDP in four years’ time. That figure would have seemed worryingly high before the crisis.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=b4d7fc9e-eedf-49c3-96d8-8218c6feea09)