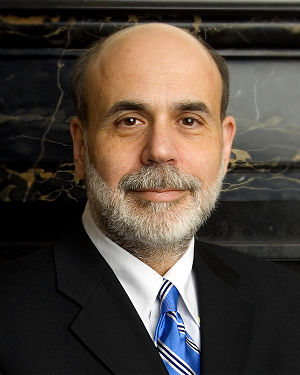

Image via Wikipedia

Tyler Durden

Recently the debate over when QE2 will occur has taken a back seat over the question of what the implications of the Fed's latest intervention in monetary policy will be, as it is now certain that Bernanke will attempt a fresh round of monetary stimulus to prevent the recent deceleration in the economy from transforming into outright deflation. Whether or not the Fed will decide to engage in QE2 on its November 3 meeting, or as others have suggested December 14, and maybe even as far out as January 25, the actual event is now a certainty. And while many have discussed this topic in big picture terms, most notably David Tepper, who on Friday stated that no matter what, stocks will benefit from QE2, few if any have actually considered what the impact of QE2 will be on the Fed's balance sheet, and how the change in composition in Fed assets will impact all marketable asset classes. We have conducted a rough analysis on how QE2 will reshape the Fed's balance sheet. We were stunned to realize that over the next 6 months the Fed may be the net buyer of nearly $3 trillion in Treasurys, an action which will likely set off a chain of events which could result in rates dropping all the way to zero, stocks surging, and gold (and other precious metals) going from current price levels to well in the 5 digit range.

No comments:

Post a Comment