Image via Wikipedia

Editorial - NYT

As Greece has tottered on the brink of fiscal chaos, threatening to drag much of Europe down with it, Wall Street’s role in the fiasco has drawn well-deserved scorn.

First came the news that Greece had entered into derivatives transactions with Goldman Sachs and other banks to hide its public debt. Then came reports that some of those same banks and various hedge funds were using credit default swaps — the type of derivative that kneecapped the American International Group — to bet on the likelihood of a Greek default and using derivatives to wager on a drop in the euro.

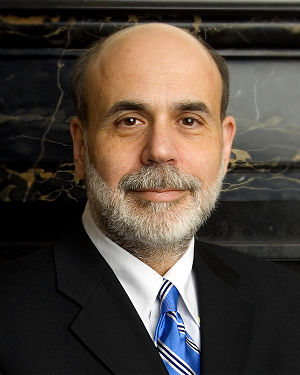

European leaders have called for an inquiry into the Greek crisis. Ben Bernanke, the Federal Reserve chairman, has told Congress that the Fed is “looking into” Wall Street’s deals with Greece, and the Justice Department is investigating the euro bets. That is better than turning a blind eye, but it is not nearly enough.

The bigger problem is in America, where markets are supposed to be fair and transparent. These particular — and particularly complicated — instruments are traded privately among banks, their clients and other investors with virtually no regulation or oversight.

The Obama administration and Congress have been talking for a year about fixing the derivatives market. Big banks have been lobbying to block change. And the longer it takes, the weaker the proposed new rules become.

Here are some of the problems that must be fixed:

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=b0465207-21fd-4004-96af-308fbf6993f3)